As a driver, there are several aspects of driving that you need to consider, from car insurance to knowing how to handle an auto accident or understanding what affects your insurance premiums. Whether you’re a new driver or a seasoned pro, being informed about these factors can save you money, prevent legal trouble, and keep you safe on the road. In this comprehensive guide, we’ll dive into car insurance, the top reasons for getting pulled over, and the most common and dangerous driving behaviors you should avoid to ensure a safe and cost-effective driving experience.

When choosing a car insurance policy, it’s essential to evaluate several key factors to ensure you’re getting the best coverage at the best price. Car insurance can be a complex and overwhelming decision, but taking the time to consider the following points can help you make an informed choice:

By carefully considering these factors, you can find a car insurance plan that fits your needs and budget while ensuring that you’re adequately covered.

No one ever wants to be involved in an auto accident, but knowing how to handle the situation properly can minimize stress and legal issues. If you’re ever in an accident, follow these essential steps:

Being prepared for an auto accident ensures that you handle the situation calmly and efficiently, protecting yourself, your passengers, and your legal interests.

Understanding the factors that affect your insurance premium can help you save money on your coverage. Your premium is determined by several variables that insurers use to assess risk, including:

By understanding these factors, you can make informed decisions to lower your insurance costs, such as maintaining a clean driving record or choosing a vehicle with a lower risk of theft.

No one likes being stopped by the police, but it’s important to understand the top reasons for getting pulled over and how to avoid them. Here are some of the most common reasons drivers get ticketed:

By staying alert and following the traffic laws, you can reduce your chances of getting pulled over and avoid costly fines.

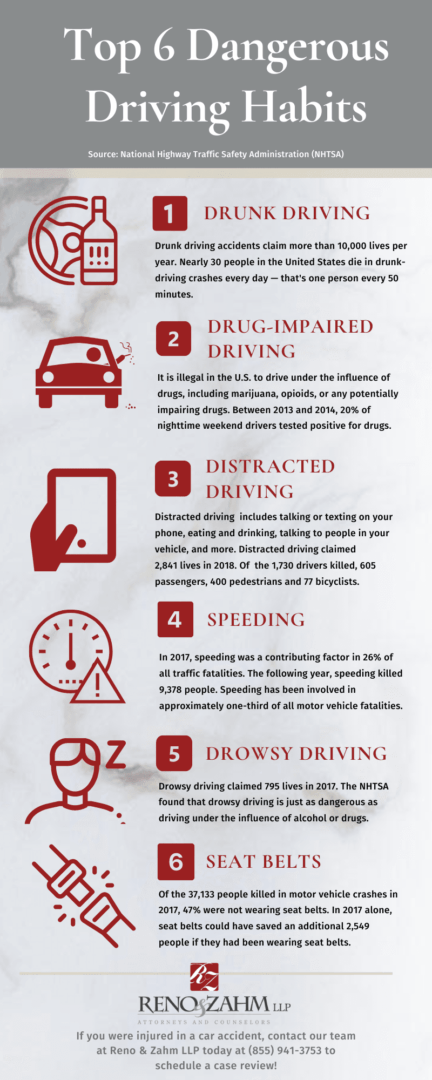

Certain driving behaviors put everyone on the road at risk. By avoiding these dangerous driving habits, you can help make the roads safer for everyone:

By adopting safer driving habits, you not only protect yourself but also help prevent accidents and improve road safety for everyone.

Whether you’re looking to lower your car insurance premiums, understand how to deal with an auto accident, or learn more about the most common driving behaviors that lead to accidents, being informed is the key to becoming a safer and more responsible driver. By following the best practices outlined in this guide, you can keep yourself and others safe, save money on insurance, and reduce your chances of getting into an accident.

Remember, driving is not just a privilege—it’s a responsibility. Stay informed, follow the rules of the road, and always drive safely.

Last Updated: July 16, 2025

Last Updated: July 16, 2025

Last Updated: July 16, 2025

Last Updated: July 14, 2025

Last Updated: January 30, 2026

Last Updated: July 14, 2025

Last Updated: January 30, 2026

Last Updated: July 14, 2025